THE NEED FOR AN OVERALL PLAN

Although identifying tax opportunities on an annual basis is a good first step for tax preparedness, strategic tax planning decisions should be made in the context of an overall financial plan (including reasonable year-by-year tax projections). An overall plan will help guide decisions that may actually include choosing to pay some additional tax in the present in order to avoid considerably more in the future.

For example, if you are likely to have funds left over at the end of your lifetime and your children are high income earners, leaving life insurance or Roth IRA assets would likely be more beneficial than leaving traditional IRA assets. If your beneficiaries are charitable organizations, then leaving IRA assets would be preferable as neither you nor the qualified charity would pay federal income tax on these assets.

Another example is Required Minimum Distributions (RMDs) from IRA accounts. RMDs must begin at age 72 years. If you have significant savings in IRA or other pre-tax retirement accounts, estimating your eventual RMD may help you identify the potential for especially large tax bills in the future that may be reduced by taking some action today.

If you are likely to spend the majority of your savings during your lifetime, tax-efficiency should be viewed as secondary to ensuring you are able to meet your needs in a variety of personal circumstances, such as an early death of a family member, high health care expenses, or a poor investment market early in your retirement. While tax planning may play a role in improving your ability to deal with these situations, it likely will not be the primary means for doing so.

These are only a few of the considerations addressed by a comprehensive plan. Contact us at Life By Design Investment Advisory Services today to determine whether you could benefit from an overall financial plan.

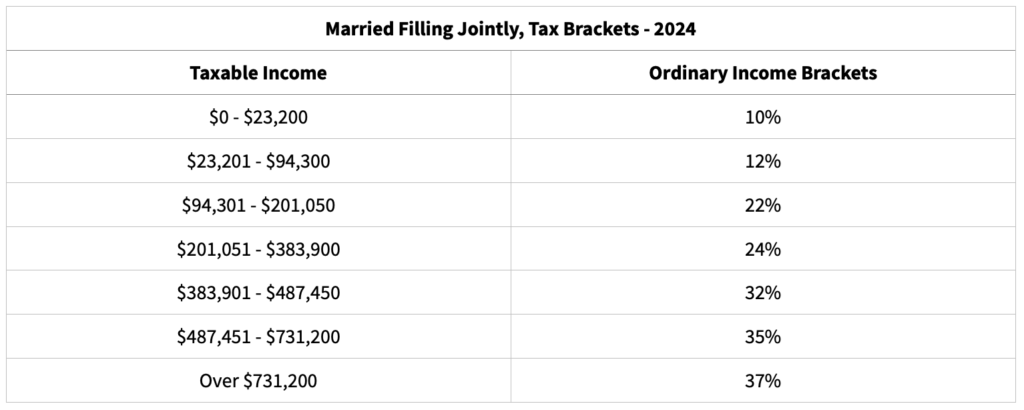

A PROGRESSIVE TAX SYSTEM

The United States federal tax system is progressive, meaning that people who have higher incomes pay a higher tax rate on each additional dollar earned. Most income can be grouped into two broad categories: ordinary income and capital gains. Each category receives its own income tax treatment.

For retirees, ordinary income most commonly includes earned income, taxable interest, rents, short-term capital gains, pension payments, and withdrawals from IRA accounts. The taxable portion of Social Security benefits is also treated as ordinary income.

Long-term capital gains and qualified dividends receive favorable tax treatment compared to ordinary income, with brackets considerably lower than those for ordinary income. These brackets, however, are tied to the amount of ordinary income a taxpayer has. So if a taxpayer had enough ordinary income to fully reach the 22% ordinary tax bracket, the first dollar of long- term capital gain would be taxed at 15%.

YOUR 2024 TAX STRATEGY

We work to provide a landscape view of your tax situation, which may allow us to suggest alternate patterns of withdrawal or contribution to retirement accounts like 401ks, IRAs or Roth IRAs. We can also help you understand when it may be beneficial to consider Roth conversions or harvest a capital gain or capital loss in your taxable accounts. Although we do not provide tax advice, this strategic tax consulting can help you and your tax advisor proactively identify opportunities to save on taxes throughout retirement.

Contact us today by phone or email [email protected] reserve your appointment to discuss strategies to improve your 2024 tax situation. For example with “tax bracket arbitrage”, allowing some IRA income to be exposed now up to the next tax bracket threshold along with a Roth conversion.

For more on the opportunities available through the use of a Roth click the button below.

Life By Design Investment Advisory Services is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.